IRS 14039 2024-2025 free printable template

Show details

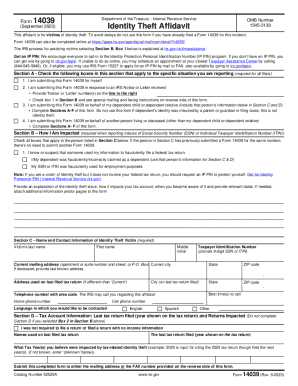

If the person in Section C has previously submitted a Form 14039 for the same incident there s no need to submit another Form 14039. To avoid delays do not use this form if you have already filed a Form 14039 for this incident. Form 14039 can also be completed online at https //apps. Help us avoid delays Do not use this form if you have already filed a Form 14039 for this incident. Form 14039 Department of the Treasury - Internal Revenue Service OMB Number 1545-2139 Identity Theft Affidavit...

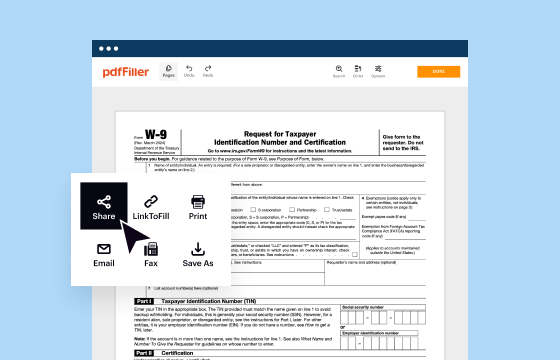

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 14039

Comprehensive Steps for Modifying Your Information on IRS Form 14039

Guidelines for Completing IRS Form 14039

Understanding and Utilizing IRS Form 14039

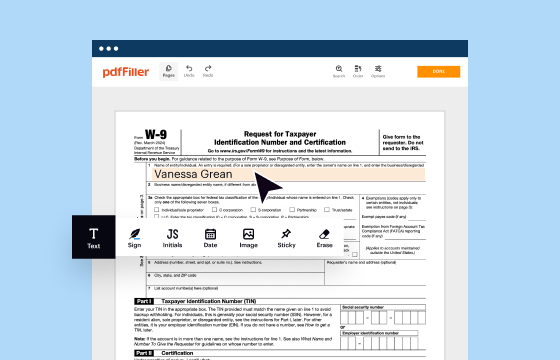

IRS Form 14039, also known as the Identity Theft Affidavit, plays a crucial role for taxpayers who suspect that someone is using their personal information to file a fraudulent tax return. This guide provides essential insights into how to navigate the form, its recent updates, and its overall significance in the tax preparation process.

Comprehensive Steps for Modifying Your Information on IRS Form 14039

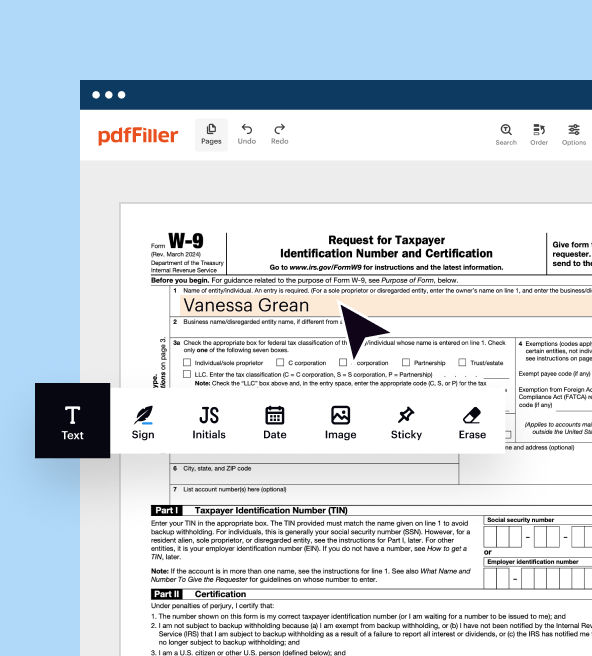

To edit the IRS Form 14039, follow these clear steps to ensure accuracy and compliance:

01

Obtain a copy of Form 14039 from the IRS website or your tax preparation software.

02

Review the information you previously submitted for correctness, focusing on personal and financial details.

03

Make necessary amendments where discrepancies occur. Ensure all changes are clearly legible.

04

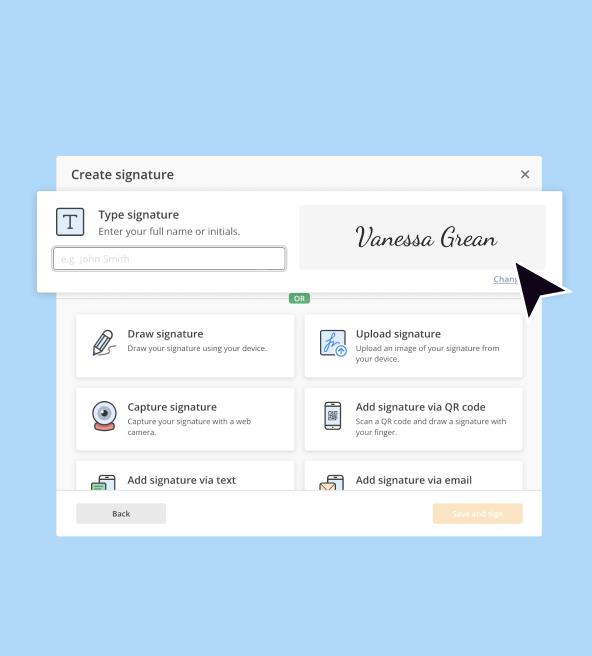

Sign and date the updated form, affirming that your revisions reflect accurate information.

05

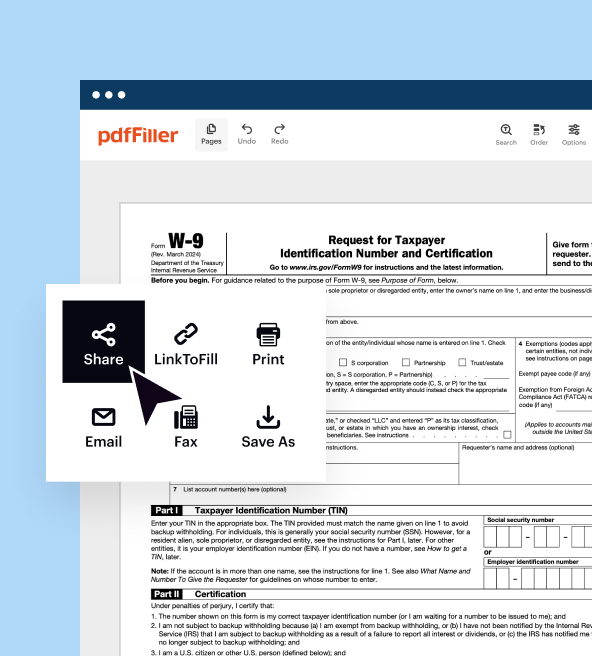

Submit the revised form to the IRS following the prescribed submission protocol.

Guidelines for Completing IRS Form 14039

To complete the IRS Form 14039 correctly, ensure you:

01

Provide personal identification information, including your full name, address, and Social Security number.

02

Clearly indicate that you suspect identity theft. This involves detailing how you believe your information was compromised.

03

Attach any supporting documentation, such as police reports or previous tax returns, which substantiate your claims.

04

Choose the method of submission that suits your circumstances—either by mail or electronically, if applicable.

Show more

Show less

Latest Developments Regarding IRS Form 14039

Latest Developments Regarding IRS Form 14039

Recent updates to the IRS Form 14039 are designed to enhance user experience and security against identity theft. Notably, the IRS has streamlined the submission process and improved guidance for taxpayers. Ensure you’re aware of these changes when filing.

Essential Knowledge About IRS Form 14039

What is IRS Form 14039?

Why is IRS Form 14039 Necessary?

Who Should File IRS Form 14039?

Conditions for Exemption Using IRS Form 14039

Deadline for Submitting IRS Form 14039

Comparing IRS Form 14039 with Other Related Forms

Transactions Governed by IRS Form 14039

Number of Copies Needed for IRS Form 14039 Submission

Consequences of Failing to Submit IRS Form 14039

Information Needed for IRS Form 14039 Filing

Additional Forms Accompanying IRS Form 14039

Where to Send IRS Form 14039

Essential Knowledge About IRS Form 14039

What is IRS Form 14039?

IRS Form 14039 is an official affidavit used by taxpayers who believe they are victims of identity theft related to their tax information. The form helps the IRS track and address fraudulent activity while protecting the rights of the taxpayer.

Why is IRS Form 14039 Necessary?

The primary purpose of IRS Form 14039 is to alert the IRS to potential identity theft incidents. By submitting this form, taxpayers can safeguard their accounts and tax returns from fraudulent submissions that may proliferate due to their stolen identities. Additionally, it assists in rectifying any issues arising from these fraudulent activities.

Who Should File IRS Form 14039?

IRS Form 14039 should be completed by individuals who:

01

Receive a notice from the IRS indicating that they have filed multiple tax returns.

02

Discover that their personal information is being used by someone else to file a tax return.

03

Have been victims of identity theft, as documented by law enforcement or financial institutions.

Conditions for Exemption Using IRS Form 14039

Exemptions may apply for taxpayers under specific circumstances, including:

01

Individuals whose total income falls under the federal poverty line.

02

Non-profit entities that are structured under certain tax laws.

03

Small businesses with income below specific thresholds that do not exceed state guidelines.

Deadline for Submitting IRS Form 14039

The submission deadline for IRS Form 14039 aligns with your overall tax filing timeline. Generally, it should be filed as soon as you suspect identity theft, though addressing it concurrently with your tax return is advisable to prevent complications.

Comparing IRS Form 14039 with Other Related Forms

Understanding the distinctions between IRS Form 14039 and similar forms is critical:

01

Form 14039 vs. Form 4506-T: Form 4506-T is a request for a transcript of tax return information, often used for verification during identity theft investigations, while Form 14039 is filed specifically to report identity theft.

02

Form 14039 vs. Form 8821: Form 8821 grants third-party representatives access to your tax information, but does not address identity theft directly.

Transactions Governed by IRS Form 14039

The IRS Form 14039 primarily pertains to any suspected fraudulent transactions linked to identity theft. This may include unauthorized filings, improper access to tax refunds, or misuse of personal details in fiscal activities.

Number of Copies Needed for IRS Form 14039 Submission

Typically, one copy of IRS Form 14039 is necessary for submission, although keeping another copy for your personal records is recommended. If you are filing alongside supporting documents, include those copies as well.

Consequences of Failing to Submit IRS Form 14039

Failing to submit IRS Form 14039 when required can result in significant penalties, such as:

01

Financial repercussions that may involve fines or delayed tax refunds.

02

Legal outcomes including potential audits or increased scrutiny on past or future tax returns.

03

Difficulty in reversing fraudulent activity without formal reporting to the IRS.

Information Needed for IRS Form 14039 Filing

The following details are essential when filing IRS Form 14039:

01

Your full name and Social Security number.

02

Your current address and prior addresses if applicable.

03

A comprehensive explanation of your identity theft situation.

04

Details of any fraudulent returns or notifications received from the IRS.

Additional Forms Accompanying IRS Form 14039

While IRS Form 14039 can be filed independently, it is beneficial to attach supporting documents, which may include Form 14021 (Identity Theft Affidavit) if there are additional complexities surrounding the case.

Where to Send IRS Form 14039

IRS Form 14039 should be submitted to the IRS at the address specified in the instructions accompanying the form. It is crucial to confirm this address as it can vary based on your location. Keep track of any correspondence for future reference.

Understanding and utilizing IRS Form 14039 is pivotal in combating identity theft. If you suspect that your tax information is being misused, take action by following these guidelines. For further assistance, consult a tax professional or visit the IRS website for detailed resources.

Show more

Show less

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

New to this skill. Still figuring out how to use to our advantage.

lank spots and missing bottom of the page, when commanded to print

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.