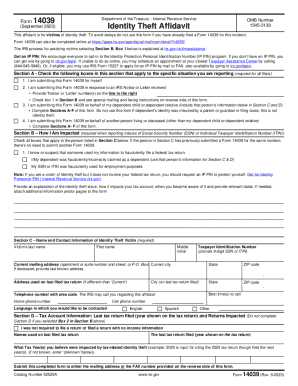

IRS 14039 2024-2026 free printable template

Instructions and Help about IRS 14039

How to edit IRS 14039

How to fill out IRS 14039

Latest updates to IRS 14039

All You Need to Know About IRS 14039

What is IRS 14039?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 14039

What should I do if I need to correct an error on my IRS 14039?

If you need to correct a mistake on your IRS 14039 form, you can submit an amended version. It's important to clearly indicate changes made and provide any necessary documentation to support the correction, ensuring your updates align with IRS guidelines.

How can I track the status of my submitted IRS 14039?

To verify the receipt and processing status of your IRS 14039, you can use the IRS online tools or contact their support. Keep in mind that common e-file rejection codes can indicate why your submission might have been rejected, prompting you to take corrective actions.

Are there any specific privacy concerns related to filing IRS 14039?

When filing IRS 14039, it's crucial to consider privacy and data security. Ensure that you securely transmit sensitive information and understand how long records of your filings must be retained under IRS policies to safeguard against unauthorized access.

Can a representative file IRS 14039 on behalf of a taxpayer?

Yes, authorized representatives can file IRS 14039 on behalf of a taxpayer with proper documentation, such as a Power of Attorney (POA). This process allows representatives to handle the filing while adhering to the necessary legal requirements.

What common errors should I look out for when submitting IRS 14039?

When submitting IRS 14039, watch for common errors such as incorrect taxpayer identification numbers or missing signatures. Additionally, being aware of these pitfalls can help prevent delays in processing and rejection of your form.

See what our users say